The Voice: March 4th, 2025

Provincial Legislature Starts Spring Session, Laying the Foundation for Compassionate Intervention, Red Tape Reduction Bill to Further Reduce Regulatory Burdens, and Trade & Tariff Insights, Webinars and Resources all in this week's edition of The Voice.

Business News

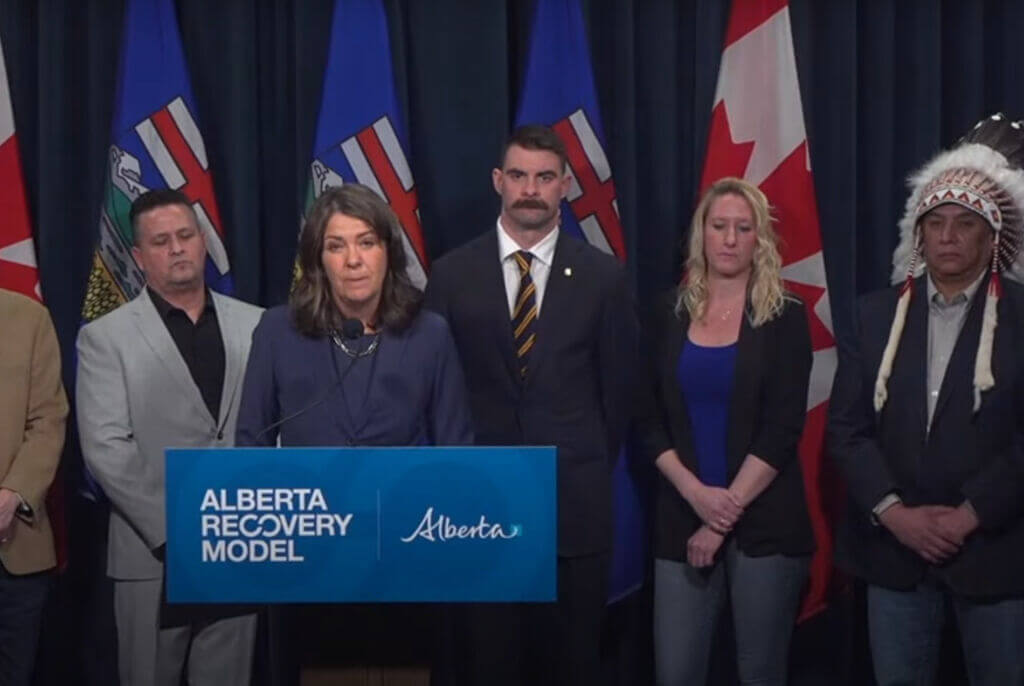

Provincial Legislature Starts Spring Session

This session will see Alberta’s government take action to support the implementation of measures announced in Budget 2025, modernizing existing legislation and reducing red tape, ensuring the province’s laws remain relevant, easy to understand and attractive to investors. Among the approximately 20 pieces of proposed legislation for the spring session is an act that would provide a uniform governance framework for professional regulatory organizations; legislation to support Albertans’ understanding of addiction treatment services, aligning with the standards set out by the Alberta Recovery Model, as well as introducing several pieces of legislation to help Albertans face the rising cost of living.

The work in the assembly will be in addition to the government’s ongoing efforts to de-escalate border and trade tensions with the U.S. amid uncertainty in global geopolitical and energy markets, reduce barriers to interprovincial trade, and maintain Alberta’s status as the best place to live, work, and raise a family. Find out more.

Laying the foundation for compassionate intervention

Alberta’s government is continuing its work to develop compassionate intervention legislation. If passed, that legislation would allow family members, guardians, health care professionals, police or peace officers to request an addiction treatment order for Albertans who are a danger to themselves or others due to their addiction or substance use. The goal is to provide stabilization, assessment and treatment so Albertans can successfully transition to community supports, such as a recovery community, to continue their recovery journey. Find out more

Red Tape Reduction bill to further reduce regulatory burdens

The Red Tape Reduction Statutes Amendment Act, 2025 introduces more key changes to streamline processes and improve services across multiple sectors. If passed, proposed changes will allow for electronic communication in the exchange of documents between landlords and tenants, improve support for charitable and fundraising organizations, facilitate further trade union participation in apprenticeship education and enable further improvements in child intervention. Find out more.

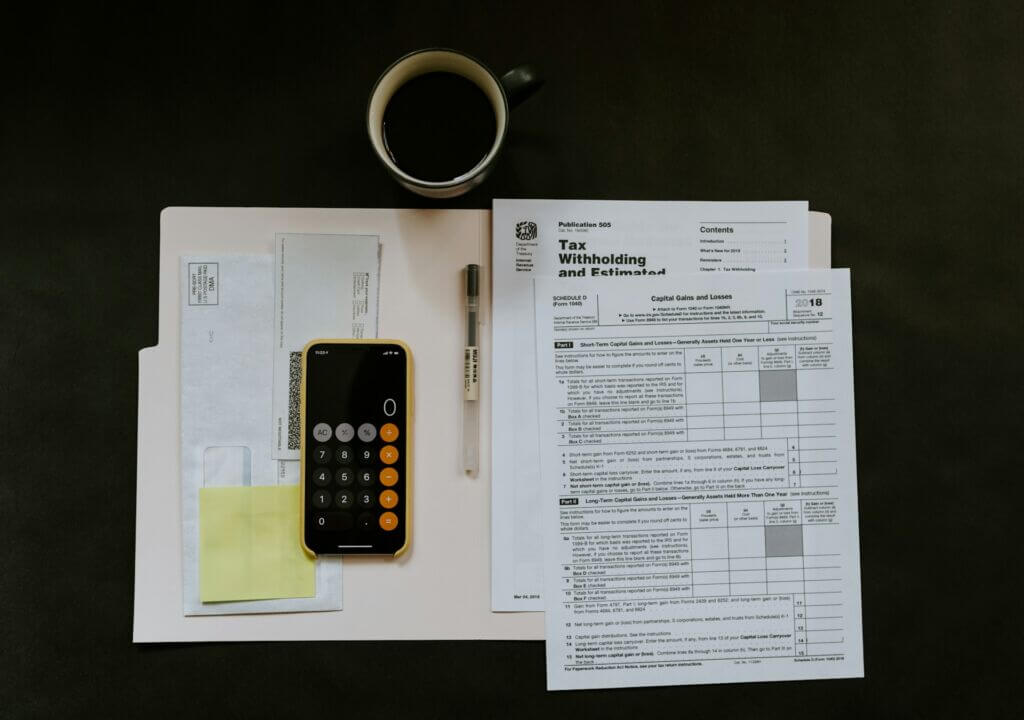

Canada Revenue Agency’s administration of the proposed capital gains taxation changes

On January 31, the Department of Finance announced that it will introduce legislation in Parliament in due course, related to the capital gains inclusion rate change with a new effective date of January 1, 2026. As a result, the Canada Revenue Agency (CRA) has reverted to administering the currently enacted capital gains inclusion rate of one-half. This means that all capital gains realized before January 1, 2026 will be subject to the currently enacted inclusion rate of one-half, unless an exemption applies.

The CRA will grant relief in respect of late-filing penalties and arrears interest until June 2, 2025, for impacted T1 Individual filers and until May 1, 2025, for impacted T3 Trust filers to provide additional time for taxpayers reporting capital dispositions to meet their tax filing obligations. With the proposed change to the effective date, the CRA will issue forms that have been reverted to the currently enacted rate in the coming weeks.

As the capital gains rate change is now proposed to be effective January 1, 2026, corporations can continue to use existing forms and tax software to file using the one-half inclusion rate until further notice. Visit the tax tip for more information.

Reporting the Canada Carbon Rebate for Small Businesses on your T2 corporation income tax return

Under the current legislation, the Canada Carbon Rebate for Small Businesses is considered assistance received from a government and is subject to taxation. As such, it must be included in taxable income when filing your T2 corporation income tax return for the year in which the rebate was received. The Government of Canada has proposed that the rebate be tax-free. However, a legislative amendment is required to implement this proposal. If a legislative amendment is enacted, the CRA will have the authority to process amended T2 corporation income tax returns. Further guidance will be provided at that time. Visit Canada Carbon Rebate for Small Businesses to stay informed.

Medicine Hat-Cypress News

Safety Codes Bulletin: Heating and ventilation systems - commercial buildings

Not all renovations or projects require a full engineering design, but the expectation and intent must be met for any work completed under Part 6, Section 6.2. Training is available for contractors to meet these expectations through ASHRAE and HRAI. For small renovations and tenant improvements in Part 9 buildings, as well as small changes in ductwork and minor tenant improvements in small suites within Part 3 buildings, we are willing to accept work completed by those trained and certified in HVAC design. Find out more.

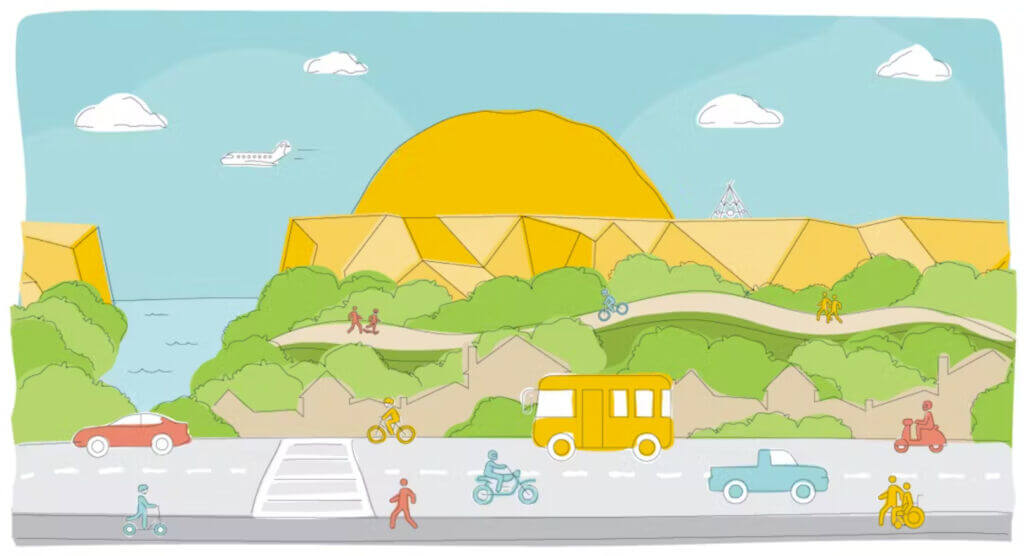

Review the Active Transportation Strategy draft plan

The Active Transportation Strategy will guide City policies and strategies that support multi-modal transportation like walking, cycling, and other active transportation methods. The high-level objectives and goals of the ATS will be to:

- Consolidate the 2010 Cycling Master Plan and Trails Master Plan

- Identify current gaps in the active transportation network and develop strategies to close these gaps

- Optimize existing infrastructure

- Create an active transportation network that is accessible and equitable

- Develop education and safety initiatives

- Cultivate a community culture which encourages and supports active transportation

Offer your feedback on this draft by attending a drop-in open house on Tuesday, March 11 from 4 to 8 p.m. in the Studio Theatre at the Esplanade or Wednesday, March 12 from 11 a.m. to 2 p.m. at Centennial Hall at Medicine Hat College. Visit the project site for more information.

Property assessments online

Your 2025 property assessment are available to view online on the City’s Assessment Map. And watch your mailbox because assessment notices will be mailed March 6! Collecting residential and non-residential property taxes is one of the various ways the City of Medicine Hat funds municipal services. Your property assessment is used to determine your share of the total property taxes collected. View the assessment map

Update: Project Clear Horizon Carbon Sequestration

The City of Medicine Hat and Imperial Oil Limited are finalizing the terms of the transfer of the Project Clear Horizon Carbon Sequestration Evaluation Agreement (CSEA) to Imperial, which will conduct feasibility work to determine if the geology is appropriate for permanent CO2 storage. A carbon capture hub for southeast Alberta was important in the economic and environmental role this hub can play in retaining our local emitting industrial partners, bolstering our ability to attract others, and maintaining the option to participate with our own carbon-emitting assets. Find out more

Brooks-Newell News

Updated CAO Bylaw

The City is updating the bylaw that defines how the Chief Administrative Officer (CAO) manages operations, following a thorough review by senior management. These updates will remove unnecessary steps and align the CAO’s responsibilities with the Municipal Government Act (MGA). The CAO will have more flexibility in handling expenses up to $50,000, allowing for quicker decision-making. They will also be able to adjust the City's staff structure as needed and write off small unpaid bills up to $500. Any extra spending beyond the budget will be reported to Council every few months, ensuring transparency. These changes help the City respond more efficiently while still keeping Council informed.

Read more at LarkSPUR News

Advocacy in Action

Southeast Alberta Chamber of Commerce 2025 Provincial Budget Analysis

We are pleased with the recent changes to individual tax rates, which have resulted in a more favorable tax environment for most individuals and have positioned our province as one of the lowest three jurisdictions for the majority of taxpayers. Keeping the corporate tax rate as lowest in the Country is a positive step forward and we would like to see future budgets also have the small business tax rate as the lowest in the country.

Small businesses with income less than $500,000 are still taxed at a rate of 2%. In order to better support the growth of small businesses, we have recommended reducing this tax rate to somewhere between 0-1%, which would place Alberta in alignment with the tax rates offered by our prairie neighbors in Manitoba and Saskatchewan. These business owners are also challenged with uncertainty and constant and continued cost increase pressures.

Decreasing the small business tax rate would provide greater incentives for entrepreneurship and help stimulate and sustain the local economy, ultimately benefiting job creation and long-term economic growth. Read the Chamber’s full budget analysis

Trade & Tariff Insights, Webinars and Resources

With U.S. tariffs being imposed against Canada, businesses should take the necessary steps to prepare for potentially disruptive U.S. trade measures as well as retaliatory measures by Canada. To support your preparations for these coming measures, please see the updates on 1) key upcoming U.S. tariffs measures, 2) the Canadian federal government’s plans for retaliation, and 3) recent Chamber initiatives responding to the threat of tariffs.

MNP: Preparing for tariff impacts that go beyond the bottom line with tariffs presenting new challenges for your business. The risk of a 25 percent increase in costs gets the attention, but there are other hidden impacts that you will need to consider.

Join the upcoming Webinar to learn more: March 12 | | Register

Calgary Economic Development, the Government of Alberta, ATB Financial, EY, JORI International Ltd. and The Manufacturing & Export Enhancement Cluster shared insights into tariffs, market diversification and how businesses can adapt to evolving trade landscape in a recent presentation. If you're interested in learning more about Calgary Economic Development's trade programming and trade missions, you can subscribe to their Export Newsletter and visit their websites Trade Accelerator Program; 2025 Trade Missions.

Read our Advocacy Insight on the Fight for Free Trade for more resources

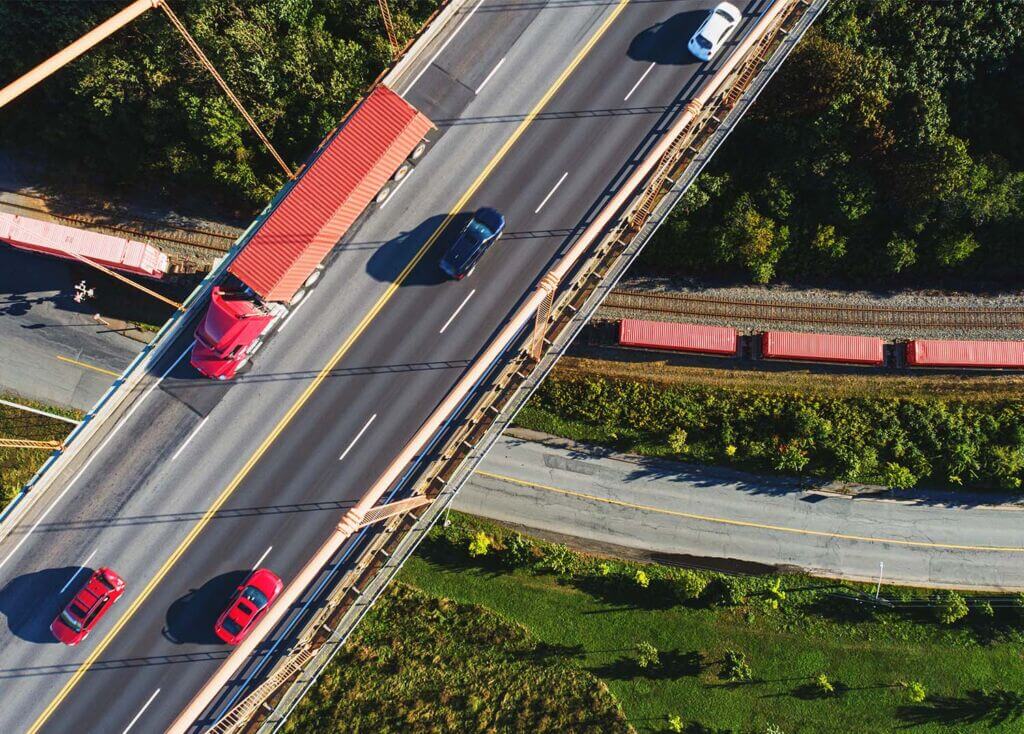

Committee on Internal Trade: Update

The Committee on Internal Trade (CIT) has been holding meetings to advance initiatives aimed at strengthening interprovincial trade. Discussions focus on improving business access to financial services, reducing regulatory barriers, and enhancing labour mobility. CIT also launched a pilot project on mutual recognition in the trucking sector to facilitate the movement of goods across Canada. The Government of Canada also announced the removal of more than half of federal exceptions to the Canadian Free Trade Agreement (CFTA), eliminating 20 of 39 federal exemptions, in order to strengthen interprovincial trade.

While this is encouraging news, exceptions to the CFTA aren’t the only barriers to internal trade. Now is the time for provinces to push forward on broad mutual recognition, streamlining the regulations and standards that make the cross-country flow of workers and goods needlessly difficult. We are pleased to see the progress continue to move forward as it aligns with our advocacy efforts locally, provincially and federally on creating a more seamless and competitive interprovincial trade environment. Addressing Barriers to Interprovincial Trade and Alberta’s Role in Enhancing Interprovincial Collaboration

Next Level Events

2025 Home & Leisure Tradeshow THIS

The 2025 Home & Leisure Tradeshow!! With over 170 vendors participating in our tradeshow, keep an eye out for Spirit Hills Winery, Lens Tools, and Brokerlink at the show!

With a diverse array of businesses and something for everyone, we are thrilled to showcase the best products, services, and technologies the region has to offer.

March 7th - 9th | Grab your discounted online tickets here!!

Business Startup Tips for Newcomers

Starting a business in a new country can feel overwhelming, but we’re here to help! If you’re new to Canada or Alberta and considering entrepreneurship, this webinar will guide you through the essential first steps before launching your business. We’ll cover key preplanning steps, legal requirements, financing, and available resources to set you up for success. By the end of the session, you’ll have a clear roadmap and the support you need to confidently move forward with your business.

BusinessLink Webinar: March 13 at 11:00 am

Register: https://businesslink.ca/event/business-startup-tips-for-newcomers/

Enriching Your Business

There's a reason Chambers Plan is Canada's #1 plan.

JoAnne Letkeman, Exclusive Chamber Group Advisor

Medicine Hat & District | (403) 504-2166 ext 1.

Scott Walls, Exclusive Chamber Group Advisor

Brooks-Newell Region | (403) 892-9675

Fuelling the Business Community

New Chamber Members

We would like to welcome Plains Motel, 24-7 Designated Driver Service, and Au Chapeau French Immersion Preschool to the Chamber Family!

We continually look forward to helping our members during their business journey and wish each the best in all future endeavors. We are extremely happy to have such amazing members, and are very glad that we can serve a part in that journey! Keep your eye out for more new member posts moving forward!

Nominate a deserving business: Alberta Business Awards of Distinction

Do you know an individual or organization that has gone above and beyond in driving Alberta’s success? We want to hear their story! The Alberta Business Awards celebrate the dedication, innovation, and hard work of individuals and organizations who have made a lasting impact. Nominate a business and help us honour their contributions to our province’s success!

Elavon Offer: Receive a $200 statement credit

Sign up for a new payment processing account today and receive a $200 statement credit!

From sales & inventory tracking and business analytics to invoice creation and staff scheduling, we will help you save time and simplify the way you run your business. This great offer ends on April 30, 2025. Visit join.paymentstart.com/cachamber to learn more.

Disclaimer: * To qualify for the promotion, you must sign up for a new payment processing account with Elavon Canada between March 1 and April 30, 2025. Merchant accounts must be activated and actively processing payment transactions by May 15, 2025 for a minimum of one week and be in an open status at the time of the incentive credit. A one-time $200 credit will be applied to your Elavon statement within 90 days after the first deposit date. Limit one credit per customer. Cannot be combined with another offer. Elavon reserves the right in its sole discretion to modify, suspend or terminate the promotion at any time without additional notice. Restrictions may apply. Services provided by Elavon Canada Company. Copyright © 2025 Elavon Canada Company. All rights reserved. Elavon is a trademark in the United States and/or other countries. All rights reserved. All features and specifications are subject to change without notice. This document is prepared by Elavon as a service for its customers. The information discussed is general in nature and may not apply to your specific situation.

Fill Up On Funding

FREE Online Government Funded Self Employment Training

FREE Online Government Funded Self Employment Training. Next virtual Self-Employment cohort starts March 17th.

Firms whose primary activity is the generation, transmission and distribution of electricity are eligible for the Electricity Human Resources Canada’s (EHRC) Empowering Futures Program, Canada’s student work placement initiative for the electricity industry. You can recieve financial incentives of up to $7,000 if you are a Canadian-owned company creating new Work-Integrated Learning (WIL) opportunities. EHRC - Empowering Futures student work placement program is now accepting applications for placements that start on or after April 1, 2025.

Funding for Alberta Culture Days 2025 is now available. The deadline to apply is March 15, 2025.

Funding Your Vision: Accessing Grants in Canada

This webinar will empower early stage women-identifying entrepreneurs in Canada by equipping them with the knowledge and tools to successfully navigate the grant application process. We will explore a variety of pre-revenue grant opportunities specifically designed to support women-led businesses, provide guidance on crafting compelling grant proposals, and discuss effective strategies for maximizing your chances of funding success.

Webinar | March 12 | Register here

Crossword Puzzle

Crossword Puzzle Answers

Did you figure it out? Here are the answers for the February 25th crossword puzzle.

Remember that subscribing to our weekly email gets you access to the crossword puzzle. Anyone who sends us their answers will get their name put into our quarterly draw.

The prize? Receive 5 promotional credits with us (for members) or credit towards a membership (for non-members)! Oh and bragging rights that you're a crossword master.

Other Resources

Other Events

BDC Entrepreneur's Learning Centre – Online | Register

BusinessLink Digital Marketing Program – booking into March | Find out more

Free Training for the Building Industry: Various Courses up to May 29, 2025 | Register

March 12 | Start Up Women Funding Your Vision: Accessing Grants in Canada | Register

Useful Links

Follow us on social media for up-to-the-minute updates

The Voice: July 8th, 2025

Strong Year-End Surplus for a Stronger Alberta, Important Updates on the Canada Carbon Rebate for Small Businesses, and New Alberta Police Service to Support Community Safety all in this week’s edition of The Voice. Business News Strong year-end surplus for a stronger Alberta Alberta’s $8.3-billion surplus sets a solid foundation for the uncertain times ahead.…

Read MoreThe Voice: July 2nd, 2025

Made in Alberta & Buy Local, Collegiate Schools to Offer Students Hands-On Training, What Businesses Need to Know about Competition Law, and Alberta’s Tourism Soars Past National Average all in this week’s edition of The Voice. Business News Made in Alberta & Buy Local Alberta producers and processors need our support now more than ever.…

Read MoreThe Voice: June 24th, 2025

Prime Minister Carney and President Trump Agree to Canada-US Deal within 30 Days, National Indigenous Peoples Day, Trade and Tariffs Resources, and a Farewell to Chat TV all in this week’s edition of The Voice. Business News Prime Minister Carney and President Trump Agree to Canada-U.S. Deal Within 30 days On the sidelines of the…

Read More